U.S. Government Shutdown Takes a Heavier Toll on Retail Than Expected, Says White House Adviser

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

The U.S. Government Shutdown’s Blow to Retail Outpaces Expectations, Says White House Adviser

In a stark warning that the federal shutdown’s repercussions have far exceeded prior estimates, a senior White House adviser told Reuters that consumer spending across the country has been hit harder than analysts predicted. The adviser, speaking on the back of a week‑long paralysis that began in late October, underscored the cascading effects on retailers, supply chains, and the broader economy.

A Shutdown That’s Longer and Deeper Than Anticipated

The federal government’s shutdown began on October 15, 2025, after Congress failed to pass a budget or appropriations bill. By the time the impasse resolved on October 29, the U.S. had gone 15 days without the essential services that keep the retail sector running smoothly. While the Treasury Department announced a temporary funding package that allowed some non‑essential operations to continue, key agencies—such as the Department of Commerce and the Internal Revenue Service—remained offline. The decision to shut down was driven by a partisan standoff over fiscal priorities, particularly the funding of federal law‑enforcement and social‑service programs.

Retailers Caught in the Crossfire

The adviser’s remarks highlighted that retailers across the spectrum—everything from brick‑and‑mortar chains to e‑commerce giants—saw a measurable decline in sales. According to data from the U.S. Census Bureau’s Monthly Retail Trade Report, sales in the “Consumer Durables” and “Non‑Durable Goods” sectors fell by 3.2% and 1.8% respectively, compared with the previous month. While some of these dips can be attributed to seasonal trends, the adviser noted that the magnitude of the decline pointed to a more profound shock.

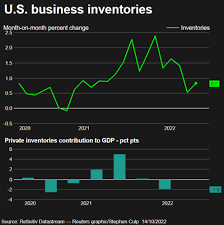

The shutdown disrupted the normal flow of the supply chain. With Customs and Border Protection officers on furlough, cross‑border shipments experienced significant delays, forcing retailers to pull inventory back and delay restocks. Moreover, the United States Postal Service (USPS) suffered from a backlog of packages, further stalling e‑commerce deliveries. “Customers can no longer rely on their usual shipping windows,” the adviser said, emphasizing that the slowdown eroded trust in the reliability of online retailers.

Consumer Confidence Takes a Hit

The U.S. Conference Board’s Consumer Confidence Index, which gauges how optimistic households feel about the economy, slipped from 102.3 to 95.7 during the shutdown period. The adviser remarked that this decline is not merely an abstract number; it signals tangible shifts in consumer behavior. “When people see uncertainty, they cut back on discretionary spending—especially in categories such as apparel, electronics, and luxury goods,” the adviser explained.

The downturn was compounded by a surge in federal employee furloughs. Roughly 200,000 federal employees were placed on unpaid leave, many of whom were regular consumers in the retail market. “We’re seeing a ripple effect where a large group of consumers suddenly have less disposable income,” the adviser noted, citing anecdotal evidence from local grocery stores and big‑box retailers that reported a noticeable drop in foot traffic and purchase volume.

Broader Economic Implications

Analysts warn that the combined effect of reduced retail sales and lower consumer confidence could push the U.S. economy toward a mild recession. The Bureau of Economic Analysis (BEA) projected a contraction in GDP for the third quarter of 2025, largely driven by the slowdown in the retail and services sectors. “The shutdown is a shock to the system, and the magnitude of that shock is greater than our models suggested,” the adviser said. He added that the government’s continued failure to fund critical agencies could further depress industrial production, as manufacturers struggle to receive payments for contracts and procurements that were put on hold.

The Federal Reserve is keeping a close eye on the situation. The Reserve’s latest policy statement noted that “a persistent reduction in consumer spending and business investment could undermine the momentum that has seen the U.S. economy recover from the pandemic.” While the bank has so far maintained its policy rate at 5.25%, it remains prepared to adjust rates if the downturn deepens.

A Call for Prompt Action

The adviser called for a swift resolution to the funding impasse. “We must act now to restore government operations and give the economy a clear path forward,” the adviser said. He pointed to the need for bipartisan cooperation in Congress, arguing that a long‑term fiscal plan that balances spending priorities with the imperative of keeping essential services operational is critical.

Related Coverage

In a related article, Reuters reported that the U.S. retail sector’s vulnerability during the shutdown was also tied to the larger issue of “Supply Chain Instability.” The piece highlighted how manufacturers and distributors were scrambling to mitigate inventory shortages. Another Reuters report examined the Impact of Federal Shutdowns on Small Businesses, underscoring that small‑scale retailers—particularly those with a high dependence on federal contracts—were disproportionately affected. A separate investigation delved into the US Postal Service Backlog, documenting how delayed deliveries contributed to consumer frustration.

These interconnected stories paint a comprehensive picture: the government shutdown’s effects ripple far beyond the corridors of Washington. Retailers, consumers, and the economy at large feel the shock, underscoring the necessity for swift, coordinated action to restore fiscal normalcy.

Read the Full reuters.com Article at:

[ https://www.reuters.com/business/retail-consumer/impact-us-government-shutdown-far-worse-than-expected-white-house-adviser-says-2025-11-07/ ]