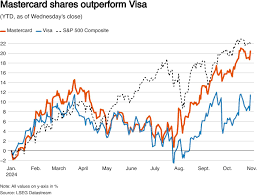

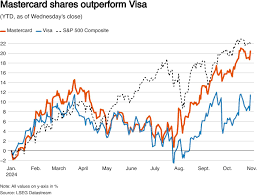

Mastercard Beats Earnings, Lowers 2026 Revenue Forecast

Locales: UNITED STATES, UNITED KINGDOM, IRELAND

NEW YORK - January 29th, 2026 - Mastercard Inc. (MA.N) today announced its fourth-quarter 2025 results, exceeding analyst expectations for both profit and revenue. However, a lowered revenue growth forecast for 2026 has cast a shadow over the positive figures, highlighting growing concerns about the global economic landscape.

The payments giant posted a net profit of $2.18 billion, translating to $2.91 per share - a significant beat against the predicted $2.82 per share according to Refinitiv data. Revenue also saw a healthy increase, reaching $6.06 billion, surpassing the anticipated $5.93 billion. This represents a 7% year-over-year revenue growth.

These results demonstrate Mastercard's continued strength in the evolving payments sector, largely driven by the ongoing consumer shift towards digital transactions. The pandemic dramatically accelerated this trend, and while the initial surge has leveled off, the convenience and security of digital payments continue to fuel consistent growth. Mastercard, like its competitor Visa, has successfully positioned itself to capitalize on this long-term behavioral change.

However, the optimism is tempered by a revised outlook for the coming year. Mastercard now projects revenue growth in the range of 7% to 9% for 2026, a reduction from its earlier forecast of 9% to 11%. This downward revision signals a growing apprehension regarding potential headwinds in the global economy.

Michael Miebach, Mastercard's CEO, attributed the cautious forecast to "the uncertain macroeconomic environment and the potential impacts from geopolitical events." This echoes concerns voiced by other major corporations in recent earnings reports, pointing to a confluence of factors impacting consumer behavior and global trade.

Several key macroeconomic indicators support this more conservative outlook. While inflation has cooled from its 2024 peak, it remains stubbornly above central bank targets in many major economies. Interest rates, though potentially stabilizing, are still significantly higher than historical averages, squeezing disposable income for consumers and increasing borrowing costs for businesses. Furthermore, ongoing geopolitical tensions - particularly in Eastern Europe and the South China Sea - continue to disrupt supply chains and create uncertainty in international markets.

Mastercard's response to these challenges involves a two-pronged strategy: continued investment in innovation and a firm focus on cost management. The company is actively expanding its network capabilities and developing value-added services, aiming to diversify its revenue streams beyond traditional transaction processing. This includes investments in areas such as data analytics, cybersecurity, and real-time payments infrastructure.

Examples of these investments include expansions into open banking solutions, allowing for secure data sharing and personalized financial services, and the development of enhanced fraud detection technologies. Mastercard is also exploring opportunities in emerging technologies like blockchain and digital currencies, though its approach remains pragmatic and focused on practical applications.

Simultaneously, Mastercard is implementing stringent cost control measures to maintain profitability in a potentially slower growth environment. This includes streamlining operations, optimizing resource allocation, and leveraging technology to improve efficiency.

Pre-market trading reflected investor reaction to the news, with Mastercard shares experiencing a nearly 1% decline. While the strong Q4 results were encouraging, the lowered guidance appears to have outweighed the positive news, suggesting that investors are prioritizing near-term economic stability over headline figures.

Looking ahead, Mastercard's performance will likely be closely tied to the trajectory of consumer spending and the overall health of the global economy. The company's ability to navigate these challenges, leverage its investments in innovation, and maintain financial discipline will be crucial in determining its long-term success.

Read the Full Channel NewsAsia Singapore Article at:

[ https://www.channelnewsasia.com/business/mastercard-profit-beats-estimates-sustained-consumer-spending-5894161 ]